Shares of NVIDIA, Intel and other U.S. chipmakers joined a downtrend on Jan. 3 after Wall Street's main semiconductor index retreated from record highs after posting its fastest gains since 2009, when the semiconductor industry bounced back after the financial crisis. Reuters was the first to notice the change in trend.

Thus, the fall in shares of AMD, Qualcomm and Broadcom by more than 2% hit the PHLX (SOX) index of semiconductor companies the most. the general condition of this industry in the financial markets»], which decreased by 2.1%. The PHLX index is down nearly 7% from its record high on December 27.

The fall in semiconductor stock prices this week is part of a general decline on Wall Street as investors expect a rate hike by the US Federal Reserve at the regulator's December meeting. By the way, the protocol has already been published – the regulator kept the rate at 5.25-5.5% per annum and hinted (without specifics yet) to a further reduction in the interest rate during 2024 (observers expect 3.75-4%).

Fueled by artificial intelligence hype and, more recently, expectations that the Federal Reserve will cut interest rates this year, the PHLX semiconductor index is up 65% through 2023, its highest performance since 2009. For comparison, the well-known stock indices NASDAQ and S&P 500 during this time added 43% and 24%, respectively.

Vacancies

Journalist, author of stories about IT, business and people in MC.todayMC.today

Lead Generation (Ticketing) Overonix Technologies

HR-manager MK-Consulting, Kiev

Architect/Head of Development Viyar

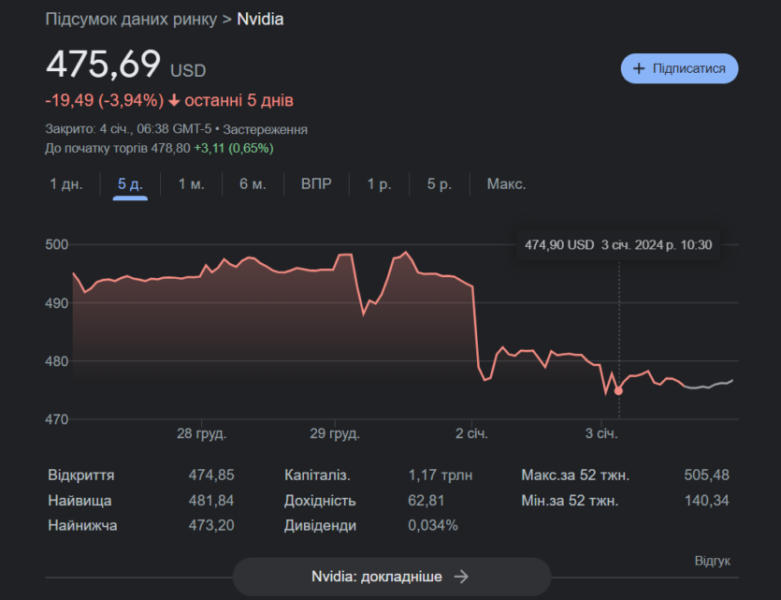

Chip stocks also benefited significantly from bets on weaker global demand last year. After memory chip manufacturers cut production, the market has almost bottomed out. And the greatest benefit in the new AI races was received by NVIDIA, which is the largest manufacturer of graphics accelerators that support the operation of generative neural networks and chat bots. The green chipmaker's capitalization more than tripled during 2023 to $1.2 trillion, making it the fifth most valuable company on Wall Street. Since the beginning of 2024, NVIDIA has lost 3.94% of its value.

The world economy should avoid a recession in 2024 (the arguments for this include GDP growth and slowing inflation in the US and the Eurozone). On the other hand, there are many uncertainties and a downward revision in consumption figures is an argument in favor of depletion of reserves and a high likelihood of a recession in the future. In the end, no one can predict how events will develop further (what awaits the US and European economies), so we can only estimate the probability of various events taking into account current circumstances.

Frontend course. Online course with practice, become a super ninja who can create a website from scratch. Get to know the course

BofA Global Research analyst Vek Arya recommended to his clients to invest in cloud computing and cars through shares of Nvidia, Marvell Technology, NXP Semiconductors and ON Semiconductor. He also included KLA Corp and Arm Holdings in his list of recommendations, given the growing complexity of chip designs. In another note, Wells Fargo analyst Joe Quatrochi noted expectations for a muted recovery for chip equipment makers in 2024, and pointed to KLA and Applied Materials as the top stocks in the space.