This acquisition will cause a stir in the space industry

Lockheed Martin, one of the world's leading aerospace and defense companies, has made an offer to purchase Terran Orbital, a leading spacecraft manufacturer. In a letter filed with the Securities and Exchange Commission (SEC) on March 1, Lockheed expressed its intention to add Terran to its space portfolio.

According to Lockheed, the offer to buy Terran is $1 per share, slightly lower than the company's current stock price of $1.07. However, this offer represents an incremental 11% over the 30-day average price of $0.90. If the offer is accepted, Lockheed will pay approximately $600,000,000.

Lockheed Martin is a major customer and investor in Terran. In 2022, the company invested $100,000,000 in Terran to expand its production capabilities. Currently, Lockheed's stake in the company exceeds 28%.

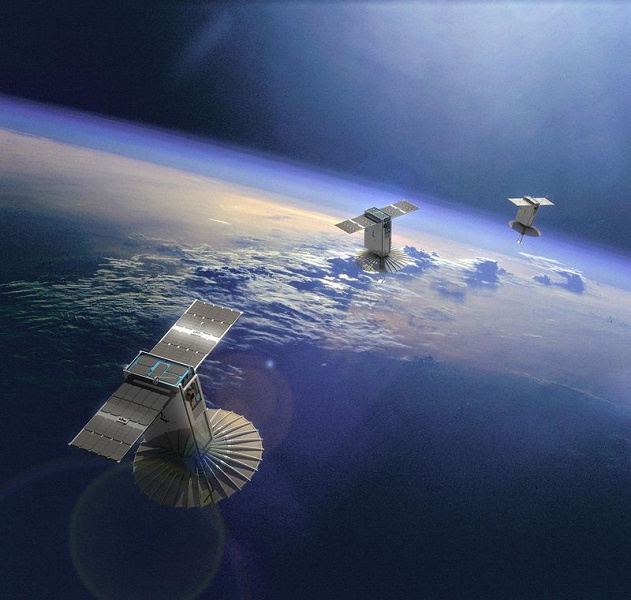

Terran Orbital plays an important role in Lockheed's satellite production, especially in large contracts with the Space Development Agency (SDA). In October 2023, Lockheed awarded Terran a contract to produce 36 Tranche 2 satellites, as well as 42 Tranche 1 satellites.

In a filing with the SEC, Lockheed described itself as «Terran»s largest customer. Terran also has a $2.4 billion contract with Rivada to build 300 internet satellites. Although Terran has already received payments from Rivada, this contract has not yet generated significant revenue.

Terran reported cash on hand of more than $70 million in the fourth quarter, up from $38.7 million in the prior-year quarter. However, investors have expressed concerns about liquidity and long-term viability as the company's shares have fallen nearly 90% since going public through a SPAC in 2022.