You no longer need to remember to pay bills every month, the service will pay them itself

Tinkoff Bank has launched a platform for paying for all types of housing and communal services (HCS). It allows you to fully automate the calculation and payment of utility bills, and the user will not have to remember this every month: the service itself will load the necessary bills, pay them and notify the client about the payment. You can upload utility bills by scanning a receipt using your mobile phone camera, or select a service provider from the list and enter your personal account number. In the future, all invoices for this provider will be loaded automatically, and the mobile application will notify you of the receipt of new invoices.

Features of the Tinkoff online platform:

- payment of all types of utility bills from all Russian providers without commission (only when paying with bank cards through bank services);

- receiving notifications about new accounts: receipts are automatically sent to your personal account from providers who are already connected to the Tinkoff platform under a direct agreement;

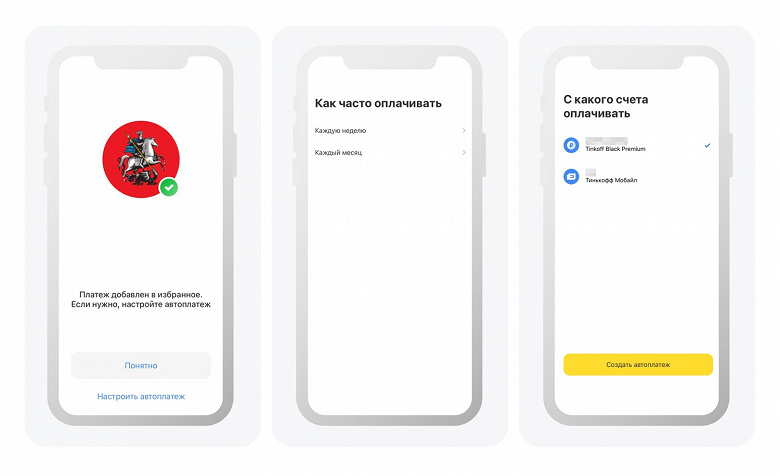

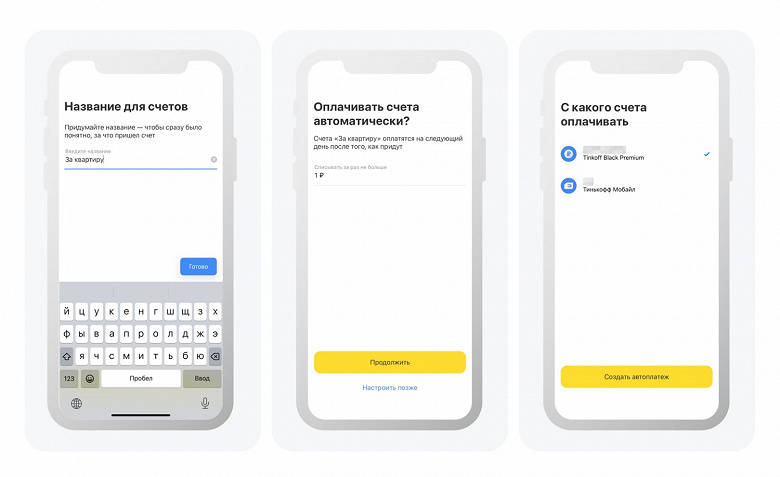

- setting up regular payments using templates: you can independently schedule the date and exact payment amount for recurring payments, the funds will be debited automatically;

- automatic payment of selected bills; it is possible to set a limit on the amount of automatic payment.

In the near future, the developers are going to add to the functions of the platform the transmission of individual meter readings and payment of all bills of the necessary providers that are connected to the housing and communal services platform from Tinkoff, with one button. You can use the platform’s services in the “Payments” section on the main screen of the Tinkoff mobile application or on the bank’s website in the “Payments” section.