The Technology section is published with the support of Favbet Tech

The recent drop in Apple shares due to concerns over iPhone sales has helped Microsoft further Close the gap further in the new round of the stock race and get closer to the title of the most valuable public company in the world.

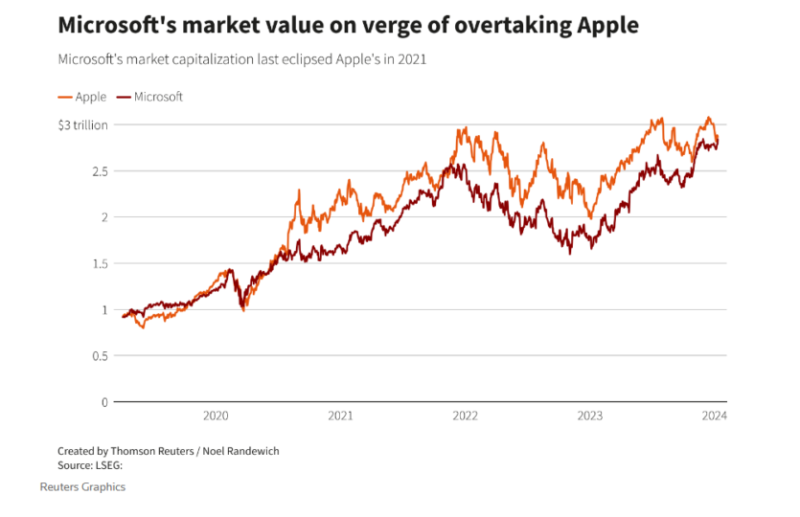

Updated [17:22]: Apple is no longer the most valuable company in the world. As expected, it was surpassed by Microsoft — With the opening of trading on January 11, Microsoft shares jumped 1.6%, and market capitalization increased to $2.875 trillion. At the same time, Apple shares lost another 0.9%, resulting in the iPhone maker's market value falling to $2.871 trillion. This is the first time since 2021 that Apple has fallen behind Microsoft in market capitalization. For now, the gap is minimal, so everything could change at any moment, but for now Microsoft, which is now also the most valuable gaming company.

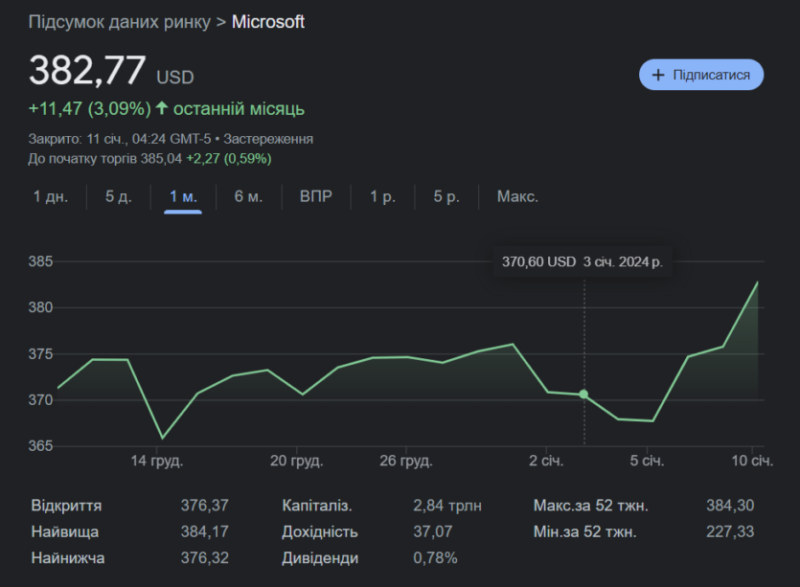

Amid renewed fears of weaker iPhone demand, Apple shares fell 4% in 2024 after rising 48% last year, while Microsoft shares rose about 2% after rising 57% in 2023. At the close on January 11, Apple shares fell 0.4%, while Microsoft overcame another 1.6% and further eroded the iPhone maker's leadership. The market value of Apple shares is now $2.866 trillion versus $2.837 trillion for Microsoft. That is, they are separated by some $29 billion. Analysts expect that in the coming weeks Microsoft will report a 16% increase in revenue to $61.1 billion in the last quarter of 2023, thanks to the strong rise of its cloud business.

Apple's market capitalization reached an all-time high on December 14, rising to $3.081 trillion, and Microsoft's current high, recorded on November 28, is $2.844 trillion.

Microsoft is preparing to overtake Apple in market value

Microsoft has briefly surpassed Apple as the most valuable company several times since 2018, most recently — in 2021 amid logistics disruptions and factory closures in China due to lockdowns due to the COVID-19 pandemic, which significantly hit the iPhone manufacturer's share price.

Vacancies

Journalist, author of stories about IT, business and people in MC.today MC.today

Kerivnik is on sale Juscutum, Kiev

Project-manager Art-sites, Inshiy

Video editor Art-sites, Remote

Overall, both tech stocks look relatively expensive based on the Forward P/E ratio, a common method for valuing publicly traded companies. According to LSEG data, Apple trades with a Forward P/E of 28, well above its 10-year average of 19, while Microsoft is now trading at 31, well above its 10-year average of 24.

How is Apple doing in general

Over the past 10+ years, many “songs” have been heard about the “beginning of the end” of Apple – at one time, perhaps, only HTC was written off more often, which, by the way, is still nominally present in the smartphone market. At the same time, Apple remains the most valuable company in the world and has almost $100 billion in free cash on its accounts – more than any other company from the Big Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla).

English course. Online learning from English for the Cambridge methodology – choosing over a billion people. Vivchiti course

Seriously, among the factors and risks that are now spoiling the mood of investors and putting pressure on the price of Apple shares, one can highlight the already mentioned concerns about the decline in iPhone sales (more details were discussed in one of the recent texts), which still bring more than 50% of the total revenue, sales decline over the last four quarters due to weakening demand for Mac, iPad and wearable devices (a combination of factors here: decreased pandemic activity + war + macroeconomic difficulties + lack of significant updates to the devices themselves). At the same time, based on the results of the last quarter of 2023, analysts predict growth of 0.7% to $117.9 billion (Apple will publish the report on February 1).

Apple also has high hopes for its acclaimed $3,499 Vision Pro headset, its biggest new product launch since the iPhone in 2007. Its sales in the US will start on February 2. But most analysts agree that sales of Apple's Vision Pro will be “relatively inconsequential” through 2024 from a financial perspective, and many have overall doubts about the product's success.

The Technology section is published with the support of Favbet Tech

Favbet Tech is IT a company with 100% Ukrainian DNA, which creates perfect services for iGaming and Betting using advanced technologies and provides access to them. Favbet Tech develops innovative software through a complex multi-component platform that can withstand enormous loads and create a unique experience for players. The IT company is part of the FAVBET group of companies.