Bank of America and IHS Markit versions

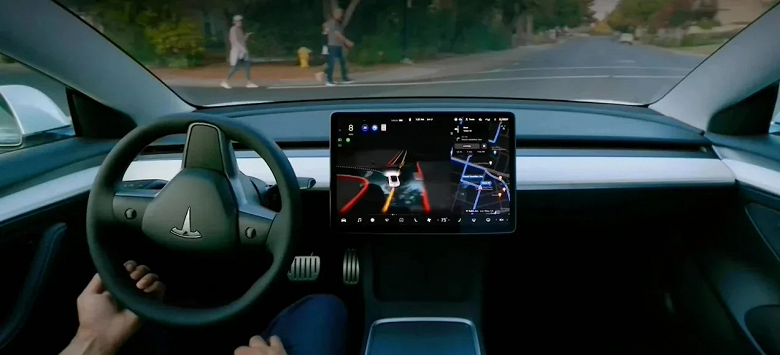

Bank of America said that if Tesla's FSD self-driving technology is successfully approved for use in China, it is expected to lead to a massive increase in the company's profits over the course of this decade.

In particular, bank analysts said that Tesla's FSD self-driving system will allow the company to earn more than $2 billion in China by 2030. Bank of America also said that if one in four of Tesla's 1.7 million owners became Tesla FSD users, the company would generate $500 million in revenue each year. And since gross margins can exceed 70%, that means revenue could be $350 million.

Tesla's annual revenue could reach $2.3 billion by 2030, according to IHS Markit's forecast for Tesla sales in China. The agency also believes that Tesla is being pressured to provide FSD technology for free to users, which may not be profitable. The company believes that increasingly tough competition in China «may push Tesla to make such a decision». But that doesn't mean Tesla won't benefit from it at all, because it will allow more cars to use FSD to speed up neural network training.

Bank of America maintained its price target on Tesla at $220, implying nearly 20% upside from current levels.

Previously it became known that the CEO of Tesla arrived in China to receive approval for the use of Tesla's Full Autonomous Driving (FSD) system. Premier of the State Council of the People's Republic of China Li Qiang ;called Tesla's work in China a successful example of cooperation between China and the USA. Elon Musk stayed in China for less than a day, but concluded a very important agreement for Tesla with Baidu.